手把手教你利用Python爬虫分析基金、股票

从前大家朋友圈都在晒美食,晒旅游,晒玩乐,现在翻来朋友圈一看,竟然有很多人在晒炒股。这是一个好现象,说明人民日益增长的美好生活需要,已经从温饱休息,变成了投资和理财。股票和基金等似乎依然还是大众眼中新鲜和高级的事物,买过股票,涨涨跌跌,也值得网上凡尔赛一番。

在通货膨胀的时代,钱放着就是在贬值。如果你有余钱且有些许碎片化时间的话,投资和理财是很有必要的。股票对于大部分散户来说,无疑是坐等着被割韭菜。所以,比起股票,对于散户,我更建议买一些基金。当然,若是真的钟情于股票,倒是可以花一些无关紧要丢了也罢的小钱玩一玩。

经常会听到别人喜欢给人推荐股票,这种人都是新手。因为真正经历了股海沉浮的人,是不敢给人推荐股票的,这句话懂的人都懂。每一个炒股的人,都应该有自己的选股系统,否则,你凭别人推荐赢得的钱,迟早会凭自己的无知输掉。

我想了想,花了一天的时间,爬了些数据,写了两个基金推荐的程序。一个是网上流行的 4433 法则,另外一个我自己想的,基于最受欢迎股票的持仓稳合度。我不买基金。需要我推荐基金的可以找我。去年来行情那么好,投资回报只做到 30% 的,都算是差的。

不妨和大家分享一下我的选股和选基金的思路。简单来说就是“抄作业”。

作为专业投资机构,基金公司选择股票都有特定的程序,一般基金公司有自己的研究人员,研究人员把自己的研究结果汇总给基金经理,基金公司也会从券商的研究机构那里付费买研究报告,另外,基金公司的研究团队还经常到上市企业实地考察,以便了解第一手资料。基金经理根据汇总过来的资料和自己的经验判断大盘走势、板块趋势及个股存在的机会,然后有的还要经过开会讨论,集思广益。最后才让操盘人员买卖股票。

作为普通人,我们大概率是比不上这些机构的。那么我们应该怎么做?我们可以抄基金公司的作业呀,把别人的成果据为己有,站在巨人的肩膀上看问题,不香么。现在问题来了,根据法律规定基金公司在特定时间,只会公布上一个季度的持仓数据,那么它的作业就是老作业,布置了新作业,却交上一次的作业,肯定是不行的。那有什么办法呢?有。就是多抄几分作业,用频率来替代概率。我的程序可以抄所有基金公司的作业,把它整合成一个作业,虽然不那么完美,但是总归是不错的。怎么样把七千多份作业抄成一份,这就是我的卖点所在。我不懂选股,但是我希望能站在基金这个巨人的肩膀上看问题,总是不会错的。

学数据科学的应该清楚,数据分析的三板斧,其实非常有用的一招就是“count”(数数),小学就会的,最简单的,也是非常有效的。

废话不多说,直接上菜。

第一步:基金数据爬取

打开天天基金网(https://fund.eastmoney.com/),通过浏览器的开发者工具,我们能观察到用户的请求和数据的返回过程。从而利用正则表达式,以及 xpath 等工具,辅以一点 python 爬虫的知识,很容易就能获取到每支基金的增长率和持仓情况。

我所用到的代码如下。

XMtool.py:

import pandas as pdimport requestsfrom lxml import etreeimport reimport numpy as npsample = '150000'sc = '6yzf'st = 'desc'ft = 'gp'dx = '1'season = 1r1r = 1r1z = 1r1y = 1r3y = 0.3333r6y = 0.3333r1n = 0.25r2n = 0.25r3n = 0.25rjnl = 0.25rcll = 1sd = '2021-01-07'ed = '2021-02-07'from PyQt5.QtWidgets import QDialogimport sysfrom PyQt5.QtWidgets import QApplicationimport dialogclass TestDialog1(QDialog,dialog.Ui_XMtool):def __init__(self,parent=None):super(TestDialog1,self).__init__(parent)self.setupUi(self)app=QApplication(sys.argv)dlg=TestDialog1()dlg.show()app.exec_()sample = dlg.sample.text()sc = dlg.sc.currentText()st = dlg.st.currentText()ft = dlg.ft.currentText()dx = dlg.dx.currentText()season = int(dlg.season.currentText())r1r = float(dlg.r1r.text())r1z = float(dlg.r1z.text())r1y = float(dlg.r1y.text())r3y = float(dlg.r3y.text())r6y = float(dlg.r6y.text())r1n = float(dlg.r1n.text())r2n = float(dlg.r2n.text())r3n = float(dlg.r3n.text())rjnl = float(dlg.rjnl.text())rcll = float(dlg.rcll.text())header = {'User-Agent': 'Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/88.0.4324.96 Safari/537.36','Referer': 'http://fund.eastmoney.com/data/fundranking.html','Cookie':'st_si=74949607860286; st_asi=delete; ASP.NET_SessionId=gekyucnll0wte0wrks2rr23b; _adsame_fullscreen_18503=1; EMFUND1=null; EMFUND2=null; EMFUND3=null; EMFUND4=null; EMFUND5=null; EMFUND6=null; EMFUND7=null; EMFUND8=null; EMFUND0=null; EMFUND9=02-07 16:37:21@#$%u521B%u91D1%u5408%u4FE1%u5DE5%u4E1A%u5468%u671F%u80A1%u7968A@%23%24005968; st_pvi=90009717841707; st_sp=2021-02-07%2012%3A14%3A29; st_inirUrl=https%3A%2F%2Fwww.baidu.com%2Flink; st_sn=21; st_psi=2021020716562364-0-0372414431'}url = 'http://fund.eastmoney.com/data/rankhandler.aspx?op=ph&dt=kf&ft='+ft+'&rs=&gs=0&sc='+sc+'&st='+st+'&sd='+sd+'&ed='+ed+'&qdii=&tabSubtype=,,,,,&pi=1&pn='+sample+'&dx='+dx+'&v=0.2692835962833908'response = requests.get(url=url, headers=header)text = response.textdata = text.split('=')[1]compile_data = re.findall("{datas:\\[(.*)\\],allRecords", str(data))[0]strip_data = str(compile_data).strip('[').strip(']')replace_quta = strip_data.replace('"', "")quota_arrays = replace_quta.split(",")intervals = [[i * 25, (i + 1) * 25] for i in range(15000)]#生成10000个区间,每个区间长度为25narrays = []for k in intervals:start, end = k[0], k[1]line = quota_arrays[start:end]narrays.append(line)header = ["基金代码", "基金简称", "基金条码", "日期","单位净值", "累计净值", "日增长率", "近1周", "近1月", "近3月", "近半年", "近1年", "近2年", "近3年","今年来", "成立来", "其他1", "其他2", "其他3", "其他4", "其他5", "其他6", "其他7", "其他8", "其他9"]df = pd.DataFrame(narrays, columns=header)df.dropna()total = df.count()[0]print("共有{}支基金!".format(total))df = df.head(total)df_part = df[["基金代码", "基金简称", "日增长率", "近1周", "近1月", "近3月", "近半年", "近1年", "近2年", "近3年","今年来", "成立来"]]df.to_csv("./基金增长率.csv", encoding="utf_8_sig")df_picked_part = df_partrates = [r1r,r1z,r1y,r3y,r6y,r1n,r2n,r3n,rjnl,rcll]i = -1for sc in ["日增长率", "近1周", "近1月", "近3月", "近半年", "近1年", "近2年", "近3年","今年来", "成立来"]:i = i+1rate = rates[i]rate_num = int(total*rate)df_tmp = df_part.sort_values(by=[sc], ascending=False, axis=0)df_tmp = df_tmp.head(rate_num)df_picked_part = pd.merge(df_picked_part,df_tmp,how='inner')print(df_picked_part.head(10))df_picked_part.to_csv("./4433法则结果.csv", encoding="utf_8_sig")rank_codes = df_part['基金代码'].values.tolist()stocks_array = []stock_funds = []total_part = int(total/100)+1for index, code in enumerate(rank_codes):# if index < 1:# print("<" * 30 + "所有基金的股票池前10情况" + ">" * 30)# print(code)if index%total_part==0:print("<" * 30 + "获得基金持仓数据中:"+str(index)+"/"+str(total)+ ">" * 30)url = "http://fundf10.eastmoney.com/FundArchivesDatas.aspx?type=jjcc&code={}&topline=10&year=&month=&rt=0.5032668912422176".format(code)head = {"Cookie": "EMFUND1=null; EMFUND2=null; EMFUND3=null; EMFUND4=null; EMFUND5=null; EMFUND6=null; EMFUND7=null; EMFUND8=null; EMFUND0=null; st_si=44023331838789; st_asi=delete; EMFUND9=08-16 22:04:25@#$%u4E07%u5BB6%u65B0%u5229%u7075%u6D3B%u914D%u7F6E%u6DF7%u5408@%23%24519191; ASP.NET_SessionId=45qdofapdlm1hlgxapxuxhe1; st_pvi=87492384111747; st_sp=2020-08-16%2000%3A05%3A17; st_inirUrl=http%3A%2F%2Ffund.eastmoney.com%2Fdata%2Ffundranking.html; st_sn=12; st_psi=2020081622103685-0-6169905557","User-Agent": "Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/84.0.4147.125 Safari/537.36"}response = requests.get(url, headers=head)text = response.textdiv = re.findall('content:\\"(.*)\\",arryear', text)[0]html_body = '<!DOCTYPE html><html lang="en"><head><meta charset="UTF-8"><title>test</title></head><body>%s</body></html>' % (div)html = etree.HTML(html_body)stock_info = html.xpath('//div[{}]/div/table/tbody/tr/td/a'.format(season))stock_money = html.xpath('//div[{}]/div/table/tbody/tr/td[@class="tor"]'.format(season))if stock_money == []:stock_money = html.xpath('//div[{}]/div/table/tbody/tr/td[@class="toc"]'.format(season))stock_attr = []stock_money_text = []for ii in stock_money:ii_text = ii.textif ii_text!=None:ii.text = ii.text.replace('---','0')stock_money_text.append(float(ii.text.replace(',','').replace('%','')))stock_one_fund = []if len(stock_info)!=0 and len(stock_money_text)!=0:count = -1for i in range(0,len(stock_info)):stock = stock_info[i]if stock.text==None:stock.text = '缺失'tmp0 = stock.text.split('.')tmp = tmp0[0]if stock.text and (tmp.isdigit() or (tmp.isupper() and tmp.isalnum() and len(tmp0)>1)):# if stock.text and stock.text.isdigit():# list_tmp = [stock.text,stock_info[i+1].text]count = count+1stock_one_fund.append([stock_info[i+1].text,stock_money_text[3*count+0],stock_money_text[3*count+1],stock_money_text[3*count+2]])stock_funds.append([code,stock_one_fund])stocks_array.extend(stock_one_fund)print("<" * 30 + "获得基金持仓数据中:done!!!"+ ">" * 30)tmp = pd.DataFrame(stock_funds,columns=['基金代码','十大重仓'])df_funds_info_extend = pd.merge(df_part,tmp,how='inner',on='基金代码')df_funds_info_extend.set_index('基金代码')df_funds_info_extend.to_csv("./基金持仓.csv", encoding="utf_8_sig")stock_info_list = []for row in df_funds_info_extend.iterrows():tenpos = row[1]['十大重仓']fund_jc = row[1]['基金简称']if len(tenpos)!=0:tmp = [tenpos[0][0],fund_jc,tenpos[0][1],tenpos[0][2],tenpos[0][3]]stock_info_list.append(tmp)df_stock_info = pd.DataFrame(stock_info_list,columns=['股票简称','所属基金','占净值比例','持股数_万','持仓市值_万'])df_stock_info.to_csv("./股票被持有信息.csv", encoding="utf_8_sig")df_stock_info_cp = df_stock_infodf_stock_info_cp['所属基金cp'] = df_stock_info['所属基金']df_stock_info_gb = df_stock_info_cp.groupby('股票简称')stock_agg_result = df_stock_info_gb.agg({'持股数_万':np.sum,'持仓市值_万':np.sum,'占净值比例':np.mean,'所属基金':len,'所属基金cp':list})stock_agg_result.columns = ['被持股数_万','被持仓市值_万','平均占比','所属基金数目','所属基金集合']stock_agg_result.to_csv("./股票被持有信息统计.csv", encoding="utf_8_sig")rank = 10stock_agg_result = stock_agg_result.sort_values(by="所属基金数目",ascending=False)stock_agg_result_head0 = stock_agg_result.head(rank)stock_agg_result = stock_agg_result.sort_values(by="被持仓市值_万",ascending=False)stock_agg_result_head1 = stock_agg_result.head(rank)stock_agg_result = stock_agg_result.sort_values(by="平均占比",ascending=False)stock_agg_result_head2 = stock_agg_result.head(rank)funds_stocks_count = []for st_funds_ in stock_funds:st_funds = st_funds_[1]tmp = [i[0] for i in st_funds]df_stock_funds = pd.DataFrame(tmp,columns=['股票简称'])count0 = pd.merge(stock_agg_result_head0,df_stock_funds,how='inner',on='股票简称').iloc[:,0].sizecount1 = pd.merge(stock_agg_result_head1,df_stock_funds,how='inner',on='股票简称').iloc[:,0].sizecount2 = pd.merge(stock_agg_result_head2,df_stock_funds,how='inner',on='股票简称').iloc[:,0].sizejc_tmp = df_part[df_part['基金代码']==st_funds_[0]].iloc[0,1]funds_stocks_count.append([jc_tmp,count0,count1,count2])df_funds_stock_count = pd.DataFrame(funds_stocks_count,columns = ['基金简称','优仓数目_所属基金数','优仓数目_被持仓市值','平均占比'])df_funds_stock_count = df_funds_stock_count.sort_values(by=["优仓数目_所属基金数"], ascending=False, axis=0)df_funds_stock_count = pd.merge(df_funds_stock_count,df_part,how='inner',on='基金简称')df_funds_stock_count.to_csv("./基金持受欢迎股数目统计.csv", encoding="utf_8_sig")

dialog.py

# -*- coding: utf-8 -*-# Form implementation generated from reading ui file 'dialog.ui'## Created by: PyQt5 UI code generator 5.9.2## WARNING! All changes made in this file will be lost!from PyQt5 import QtCore, QtGui, QtWidgetsclass Ui_XMtool(object):def setupUi(self, XMtool):XMtool.setObjectName("XMtool")XMtool.resize(701, 622)self.verticalLayout = QtWidgets.QVBoxLayout(XMtool)self.verticalLayout.setObjectName("verticalLayout")self.formGroupBox_2 = QtWidgets.QGroupBox(XMtool)self.formGroupBox_2.setObjectName("formGroupBox_2")self.gridLayout = QtWidgets.QGridLayout(self.formGroupBox_2)self.gridLayout.setObjectName("gridLayout")self.label_18 = QtWidgets.QLabel(self.formGroupBox_2)self.label_18.setObjectName("label_18")self.gridLayout.addWidget(self.label_18, 0, 0, 1, 1)self.pushButton = QtWidgets.QPushButton(self.formGroupBox_2)self.pushButton.setObjectName("pushButton")self.gridLayout.addWidget(self.pushButton, 2, 0, 1, 2)self.frame = QtWidgets.QFrame(self.formGroupBox_2)self.frame.setObjectName("frame")self.formLayout_4 = QtWidgets.QFormLayout(self.frame)self.formLayout_4.setObjectName("formLayout_4")self.label = QtWidgets.QLabel(self.frame)self.label.setObjectName("label")self.formLayout_4.setWidget(0, QtWidgets.QFormLayout.LabelRole, self.label)self.r1r = QtWidgets.QLineEdit(self.frame)self.r1r.setObjectName("r1r")self.formLayout_4.setWidget(0, QtWidgets.QFormLayout.FieldRole, self.r1r)self.label_2 = QtWidgets.QLabel(self.frame)self.label_2.setObjectName("label_2")self.formLayout_4.setWidget(1, QtWidgets.QFormLayout.LabelRole, self.label_2)self.r1z = QtWidgets.QLineEdit(self.frame)self.r1z.setObjectName("r1z")self.formLayout_4.setWidget(1, QtWidgets.QFormLayout.FieldRole, self.r1z)self.label_3 = QtWidgets.QLabel(self.frame)self.label_3.setObjectName("label_3")self.formLayout_4.setWidget(2, QtWidgets.QFormLayout.LabelRole, self.label_3)self.r1y = QtWidgets.QLineEdit(self.frame)self.r1y.setObjectName("r1y")self.formLayout_4.setWidget(2, QtWidgets.QFormLayout.FieldRole, self.r1y)self.label_4 = QtWidgets.QLabel(self.frame)self.label_4.setObjectName("label_4")self.formLayout_4.setWidget(3, QtWidgets.QFormLayout.LabelRole, self.label_4)self.r3y = QtWidgets.QLineEdit(self.frame)self.r3y.setObjectName("r3y")self.formLayout_4.setWidget(3, QtWidgets.QFormLayout.FieldRole, self.r3y)self.label_5 = QtWidgets.QLabel(self.frame)self.label_5.setObjectName("label_5")self.formLayout_4.setWidget(4, QtWidgets.QFormLayout.LabelRole, self.label_5)self.r6y = QtWidgets.QLineEdit(self.frame)self.r6y.setObjectName("r6y")self.formLayout_4.setWidget(4, QtWidgets.QFormLayout.FieldRole, self.r6y)self.label_6 = QtWidgets.QLabel(self.frame)self.label_6.setObjectName("label_6")self.formLayout_4.setWidget(5, QtWidgets.QFormLayout.LabelRole, self.label_6)self.r1n = QtWidgets.QLineEdit(self.frame)self.r1n.setObjectName("r1n")self.formLayout_4.setWidget(5, QtWidgets.QFormLayout.FieldRole, self.r1n)self.label_7 = QtWidgets.QLabel(self.frame)self.label_7.setObjectName("label_7")self.formLayout_4.setWidget(6, QtWidgets.QFormLayout.LabelRole, self.label_7)self.r2n = QtWidgets.QLineEdit(self.frame)self.r2n.setObjectName("r2n")self.formLayout_4.setWidget(6, QtWidgets.QFormLayout.FieldRole, self.r2n)self.label_8 = QtWidgets.QLabel(self.frame)self.label_8.setObjectName("label_8")self.formLayout_4.setWidget(7, QtWidgets.QFormLayout.LabelRole, self.label_8)self.r3n = QtWidgets.QLineEdit(self.frame)self.r3n.setObjectName("r3n")self.formLayout_4.setWidget(7, QtWidgets.QFormLayout.FieldRole, self.r3n)self.label_9 = QtWidgets.QLabel(self.frame)self.label_9.setObjectName("label_9")self.formLayout_4.setWidget(8, QtWidgets.QFormLayout.LabelRole, self.label_9)self.rjnl = QtWidgets.QLineEdit(self.frame)self.rjnl.setObjectName("rjnl")self.formLayout_4.setWidget(8, QtWidgets.QFormLayout.FieldRole, self.rjnl)self.label_10 = QtWidgets.QLabel(self.frame)self.label_10.setObjectName("label_10")self.formLayout_4.setWidget(9, QtWidgets.QFormLayout.LabelRole, self.label_10)self.rcll = QtWidgets.QLineEdit(self.frame)self.rcll.setObjectName("rcll")self.formLayout_4.setWidget(9, QtWidgets.QFormLayout.FieldRole, self.rcll)self.gridLayout.addWidget(self.frame, 1, 1, 1, 1)self.frame_2 = QtWidgets.QFrame(self.formGroupBox_2)self.frame_2.setObjectName("frame_2")self.label_11 = QtWidgets.QLabel(self.frame_2)self.label_11.setGeometry(QtCore.QRect(18, 18, 96, 24))self.label_11.setObjectName("label_11")self.label_12 = QtWidgets.QLabel(self.frame_2)self.label_12.setGeometry(QtCore.QRect(18, 61, 96, 24))self.label_12.setObjectName("label_12")self.sc = QtWidgets.QComboBox(self.frame_2)self.sc.setGeometry(QtCore.QRect(126, 61, 91, 30))self.sc.setObjectName("sc")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.addItem("")self.sc.setItemText(15, "")self.label_13 = QtWidgets.QLabel(self.frame_2)self.label_13.setGeometry(QtCore.QRect(18, 103, 96, 24))self.label_13.setObjectName("label_13")self.st = QtWidgets.QComboBox(self.frame_2)self.st.setGeometry(QtCore.QRect(126, 103, 90, 30))self.st.setObjectName("st")self.st.addItem("")self.st.addItem("")self.label_14 = QtWidgets.QLabel(self.frame_2)self.label_14.setGeometry(QtCore.QRect(18, 145, 96, 24))self.label_14.setObjectName("label_14")self.ft = QtWidgets.QComboBox(self.frame_2)self.ft.setGeometry(QtCore.QRect(126, 145, 90, 30))self.ft.setObjectName("ft")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.ft.addItem("")self.label_15 = QtWidgets.QLabel(self.frame_2)self.label_15.setGeometry(QtCore.QRect(18, 187, 96, 24))self.label_15.setObjectName("label_15")self.dx = QtWidgets.QComboBox(self.frame_2)self.dx.setGeometry(QtCore.QRect(126, 187, 55, 30))self.dx.setObjectName("dx")self.dx.addItem("")self.dx.addItem("")self.label_16 = QtWidgets.QLabel(self.frame_2)self.label_16.setGeometry(QtCore.QRect(18, 229, 96, 24))self.label_16.setObjectName("label_16")self.season = QtWidgets.QComboBox(self.frame_2)self.season.setGeometry(QtCore.QRect(126, 229, 56, 30))self.season.setObjectName("season")self.season.addItem("")self.season.addItem("")self.season.addItem("")self.season.addItem("")self.sample = QtWidgets.QLineEdit(self.frame_2)self.sample.setGeometry(QtCore.QRect(126, 18, 151, 30))self.sample.setObjectName("sample")self.gridLayout.addWidget(self.frame_2, 1, 0, 1, 1)self.label_17 = QtWidgets.QLabel(self.formGroupBox_2)self.label_17.setObjectName("label_17")self.gridLayout.addWidget(self.label_17, 0, 1, 1, 1)self.frame.raise_()self.frame_2.raise_()self.label_18.raise_()self.label_17.raise_()self.pushButton.raise_()self.verticalLayout.addWidget(self.formGroupBox_2)self.retranslateUi(XMtool)self.pushButton.clicked.connect(XMtool.accept)QtCore.QMetaObject.connectSlotsByName(XMtool)def retranslateUi(self, XMtool):_translate = QtCore.QCoreApplication.translateXMtool.setWindowTitle(_translate("XMtool", "股林秘籍小明三式"))XMtool.setToolTip(_translate("XMtool", "<html><head/><body><p>欢迎使用小明选股软件!</p></body></html>"))XMtool.setWhatsThis(_translate("XMtool", "<html><head/><body><p>不认识爸爸?</p></body></html>"))self.label_18.setText(_translate("XMtool", "基金数据参数设定:"))self.pushButton.setText(_translate("XMtool", "小明已确定"))self.label.setText(_translate("XMtool", "日增长率"))self.r1r.setText(_translate("XMtool", "1"))self.label_2.setText(_translate("XMtool", "近1周"))self.r1z.setText(_translate("XMtool", "1"))self.label_3.setText(_translate("XMtool", "近1月"))self.r1y.setText(_translate("XMtool", "1"))self.label_4.setText(_translate("XMtool", "近3月"))self.r3y.setText(_translate("XMtool", "0.33333"))self.label_5.setText(_translate("XMtool", "近6月"))self.r6y.setText(_translate("XMtool", "0.33333"))self.label_6.setText(_translate("XMtool", "近1年"))self.r1n.setText(_translate("XMtool", "0.25"))self.label_7.setText(_translate("XMtool", "近2年"))self.r2n.setText(_translate("XMtool", "0.25"))self.label_8.setText(_translate("XMtool", "近3年"))self.r3n.setText(_translate("XMtool", "0.25"))self.label_9.setText(_translate("XMtool", "今年来"))self.rjnl.setText(_translate("XMtool", "0.25"))self.label_10.setText(_translate("XMtool", "成立来"))self.rcll.setText(_translate("XMtool", "1"))self.label_11.setText(_translate("XMtool", "样本数量"))self.label_12.setText(_translate("XMtool", "排序键值"))self.sc.setItemText(0, _translate("XMtool", "6yzf"))self.sc.setItemText(1, _translate("XMtool", "dm"))self.sc.setItemText(2, _translate("XMtool", "jc"))self.sc.setItemText(3, _translate("XMtool", "jzrq"))self.sc.setItemText(4, _translate("XMtool", "dwjz"))self.sc.setItemText(5, _translate("XMtool", "ljjz"))self.sc.setItemText(6, _translate("XMtool", "rzdf"))self.sc.setItemText(7, _translate("XMtool", "zzf"))self.sc.setItemText(8, _translate("XMtool", "1yzf"))self.sc.setItemText(9, _translate("XMtool", "3yzf"))self.sc.setItemText(10, _translate("XMtool", "1nzf"))self.sc.setItemText(11, _translate("XMtool", "2nzf"))self.sc.setItemText(12, _translate("XMtool", "3nzf"))self.sc.setItemText(13, _translate("XMtool", "jnzf"))self.sc.setItemText(14, _translate("XMtool", "lnzf"))self.label_13.setText(_translate("XMtool", "排序方式"))self.st.setItemText(0, _translate("XMtool", "desc"))self.st.setItemText(1, _translate("XMtool", "asc"))self.label_14.setText(_translate("XMtool", "基金类型"))self.ft.setItemText(0, _translate("XMtool", "all"))self.ft.setItemText(1, _translate("XMtool", "gp"))self.ft.setItemText(2, _translate("XMtool", "hh"))self.ft.setItemText(3, _translate("XMtool", "zs"))self.ft.setItemText(4, _translate("XMtool", "qdii"))self.ft.setItemText(5, _translate("XMtool", "zq"))self.ft.setItemText(6, _translate("XMtool", "lof"))self.ft.setItemText(7, _translate("XMtool", "fof"))self.label_15.setText(_translate("XMtool", "是否可购"))self.dx.setItemText(0, _translate("XMtool", "1"))self.dx.setItemText(1, _translate("XMtool", "0"))self.label_16.setText(_translate("XMtool", "季度选择"))self.season.setItemText(0, _translate("XMtool", "1"))self.season.setItemText(1, _translate("XMtool", "2"))self.season.setItemText(2, _translate("XMtool", "3"))self.season.setItemText(3, _translate("XMtool", "4"))self.sample.setText(_translate("XMtool", "15000"))self.label_17.setText(_translate("XMtool", "四四三三法则参数:"))

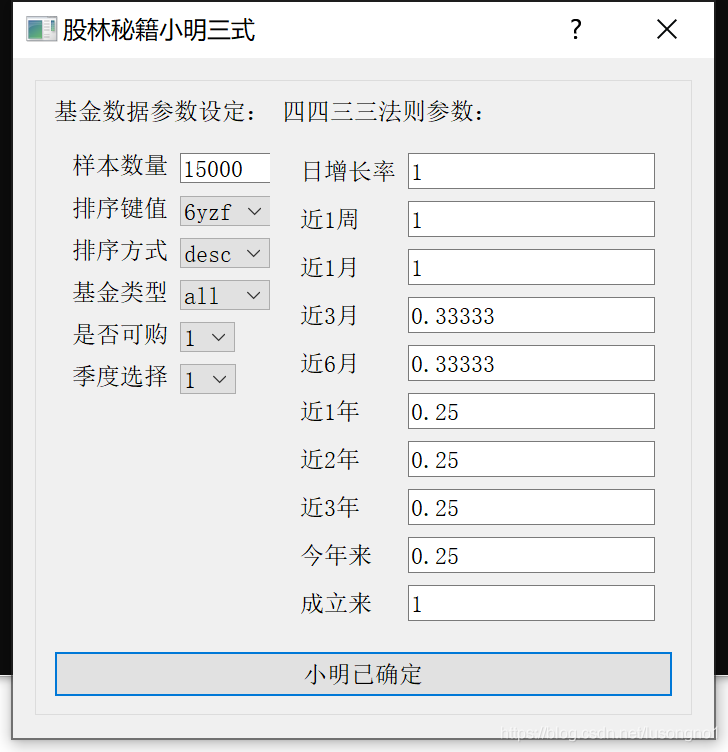

运行之后,需要填一些参数,如下。

确定之后,除了爬下来了我们后面所要用到的全部数据之外,我们还利用 4433 法则,对于基金进行了一个初步的分析和筛选。

第二步:股票增持计算

有了上面爬下来的原始数据之后,我们就可以统计:单股票被基金公司持有的数量、单股票被基金公司持有的市值和持有单股票基金公司的数目。对于不同的相邻季度,我们可以计算这三个量的增长,又得到三个新的指标。对于不同的指标进行降排序,我们可以得到股票在基金公司中的受欢迎程度,以此得到股票好坏度,指标值作为权重。不同的指标得到的不同的股票排序还可以拿前几取交集。从而我们就得到了基金公司们期待值比较高的股票。

我所用的代码如下:

#!/usr/bin/env python# coding: utf-8# In[]:import pandas as pd#import osimport tkinter as tkfrom tkinter import filedialogdef getLocalFile():root=tk.Tk()root.withdraw()filePath=filedialog.askopenfilename()print('文件路径:',filePath)return filePath#if __name__ == '__main__':# In[]:file1 = getLocalFile()file2 = getLocalFile()#sheet1 = pd.read_csv('./all_1/股票被持有信息统计.csv')sheet1 = pd.read_csv(file1)sheet1#sheet2 = pd.read_csv('./all_2/股票被持有信息统计.csv')sheet2 = pd.read_csv(file2)sheet3 = pd.merge(sheet1,sheet2,how='inner',on='股票简称')sheet3sheet3['增持股数'] = sheet3['被持股数_万_x'] - sheet3['被持股数_万_y']# In[]:sheet3['增持市值'] = sheet3['被持仓市值_万_x'] - sheet3['被持仓市值_万_y']#sheet3['增持占比'] = sheet3['平均占比_x'] - sheet3['平均占比_y']sheet3['增持基金数量'] = sheet3['所属基金数目_x'] - sheet3['所属基金数目_y']sheet3.to_csv('增持情况统计.csv',encoding="utf_8_sig")

第三步:好股基金选取

第二步中,我们其实已经得到了被基金公司看重的股票,如果炒股,直接取其前几,按其权重进行金额配置即可。现在问题是,国内股票交易,一手起步,选出来的股票很贵,比如说茅台,你不一定买得起。这时候,我们还是寄希望于买基金。我们希望选出的基金的持仓和我们选出的好股票集合的“相似度”尽可能高。相似度的衡量又很多方法。比如说:基金持有的十大重仓含有好股的数目、基金持有的十大重仓含有好股的市值、基金持有的十大重仓含有好股的占比、基金持有的十大重仓含有好股的加权占比(加权基于增持市值或增持基金数量)等等。

下面是我所用到的代码,细节可看。

#!/usr/bin/env python# coding: utf-8# In[]:import pandas as pd#import os# In[]:import tkinter as tkfrom tkinter import filedialogdef getLocalFile():root=tk.Tk()root.withdraw()filePath=filedialog.askopenfilename()print('文件路径:',filePath)return filePath#if __name__ == '__main__':# In[]print('请输入增持情况统计:')increase_hold_add = getLocalFile()inc = pd.read_csv(increase_hold_add,index_col = 0)inc# In[]:#print('请输入比率:')str_num = input("Enter your number: ")rate = int(str_num)rate# In[]:inc_sort_zcgs = inc.sort_values(by=["增持股数"], ascending=False, axis=0)inc_sort_zcsz = inc.sort_values(by=["增持市值"], ascending=False, axis=0)inc_sort_zcjjsl = inc.sort_values(by=["增持基金数量"], ascending=False, axis=0)inc_sort_zcgsinc_sort_zcgs = inc_sort_zcgs.head(rate)inc_sort_zcsz = inc_sort_zcsz.head(rate)inc_sort_zcjjsl = inc_sort_zcjjsl.head(rate)inc_merge = pd.merge(inc_sort_zcsz,inc_sort_zcjjsl,how='inner',on='股票简称')inc_mergeintersec = inc_merge['股票简称']intersecprint('选出来的前{}股票交集为:'.format(rate))print(intersec)print('共{}只!'.format(len(intersec)))# In[]:print('请选择基金持仓:')funds_hold_add = getLocalFile()funds_hold = pd.read_csv(funds_hold_add,index_col = 0)stock_funds = funds_holdstock_fundsintersecintersec_ex = pd.merge(intersec,inc,how='inner',on='股票简称')intersec_ex['权重_增持市值'] = intersec_ex['增持市值']/intersec_ex['增持市值'].sum()intersec_ex['权重_增持基金数量'] = intersec_ex['增持基金数量']/intersec_ex['增持基金数量'].sum()intersec_ex.to_csv("./好股.csv", encoding="utf_8_sig")# In[ ]:result = []# pd.DataFrame()for row in stock_funds.iterrows():tenpos = row[1]['十大重仓']exec('tps='+tenpos)fund_jc = row[1]['基金简称']#tmp = [i[0] for i in tps]#rate = [r[1] for r in tps]list_tmp = [[i[0],i[1]] for i in tps]df_stock_rate = pd.DataFrame(list_tmp,columns=['股票简称','股票占比'])# good_stock_rate# df_stock_funds = pd.DataFrame(tmp,columns=['股票简称'])# print(df_stock_funds)good_stock = pd.merge(intersec_ex,df_stock_rate,how='inner',on='股票简称')#.iloc[:,0]count = good_stock['股票简称'].sizerate_vector = good_stock['股票占比']total_rate = rate_vector.sum()tmp = (rate_vector.mul(good_stock['权重_增持市值']))#.sumtmp = tmp.sum()total_rate_weighted_zcsz = tmptmp = (rate_vector.mul(good_stock['权重_增持基金数量']))#.sumtmp = tmp.sum()total_rate_weighted_zcjjsl = tmp#good_stock_jc = good_stock['基金简称']result.append([fund_jc,count,total_rate,total_rate_weighted_zcsz,total_rate_weighted_zcjjsl])pd_result = pd.DataFrame(result,columns = ['基金简称','好股数目','好股占比','加权好股占比_增持市值','加权好股占比_增持基金数量'])pd_result = pd_result.sort_values(by='加权好股占比_增持市值',ascending=False)pd_result = pd.merge(pd_result,stock_funds,how='inner',on='基金简称')# In[]:pd_result.to_csv("./基金持好股情况统计.csv", encoding="utf_8_sig")print('完成!按任意键退出!')stop = input()

使用以往的数据做个测试验证,如下:

从上图可看出,用我的基金选择策略,选出来的基金一个月涨跌为 15 个点,两个指数基金翻车,只有百分之五,勉强跑得赢上证。

“风险越高,收益越高”总是不变的铁律,从这个角度来看,似乎就不必纠结于哪种方案或者策略收益是最高的,差不多就行了。

最后给大家推荐视频号,每天更新爬虫高阶实战视频。

扫描关注👇

自强不息