FreqTrade—又强又简单的加密货币自动交易机器人

Freqtrade 是一个用 Python 编写的免费开源加密货币交易机器人。它旨在支持所有主要交易所并通过 Telegram 或 webUI 进行控制。功能包含回测、绘图和资金管理工具以及通过机器学习的策略优化。

目前支持的交易所:

Binance (*Note for binance users)

Bittrex

FTX

Gate.io

Kraken

OKX

特性:

1. 基于 Python 3.8+:适用于任何操作系统 - Windows、macOS 和 Linux。

2. 持久性:持久性是通过 sqlite 实现的。

3. Dry-run:不花钱运行机器人。

4. 回测:模拟买入/卖出策略。

5. 通过机器学习进行策略优化:使用机器学习通过真实的交易所数据优化买入/卖出策略参数。

6. 边缘头寸规模计算您的胜率、风险回报率、最佳止损位并在为每个特定市场建立头寸之前调整头寸规模。

7. 白名单加密货币:选择你要交易的加密货币或使用动态白名单。

8. 黑名单加密货币:选择你想要避免的加密货币。

9. 内置 WebUI:内置 Web UI 来管理你的机器人。

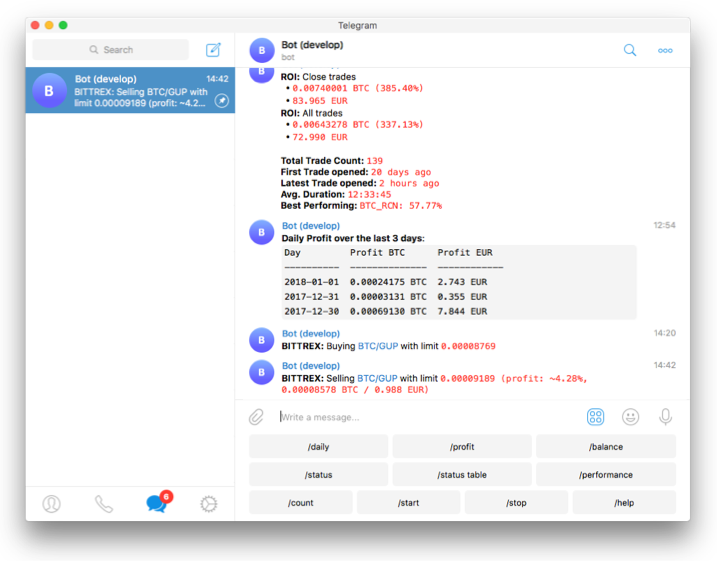

10. 可通过 Telegram管理:使用 Telegram 管理机器人。

11. 以法定货币显示盈亏:以法定货币显示你的盈亏。

12. 表现状态报告:提供你当前交易的表现状态。

1.准备

开始之前,你要确保Python和pip已经成功安装在电脑上,如果没有,可以访问这篇文章:超详细Python安装指南 进行安装。

(可选1) 如果你用Python的目的是数据分析,可以直接安装Anaconda:Python数据分析与挖掘好帮手—Anaconda,它内置了Python和pip.

(可选2) 此外,推荐大家用VSCode编辑器,它有许多的优点:Python 编程的最好搭档—VSCode 详细指南。

在Linux/MacOS下,三行命令就能完成安装:

git clone -b develop https://github.com/freqtrade/freqtrade.git

cd freqtrade

./setup.sh --install如果你无法克隆此项目,请在Python实用宝典公众号后台回复:freqtrade 下载。

Windows环境下打开Cmd(开始—运行—CMD),输入命令安装依赖:

git clone https://github.com/freqtrade/freqtrade.git

cd freqtrade

# 安装ta-lib

pip install build_helpers/TA_Lib-0.4.24-cp38-cp38-win_amd64.whl

pip install -r requirements.txt

pip install -e .

freqtrade请注意,此处安装ta-lib时项目方提供了python3.8/3.9/3.10,其他Python版本请自行搜索下载。

输入freqtrade时,显示以下信息说明安装成功:

(freqtrade) D:\CODE\trader\freqtrade>freqtrade

2022-02-17 19:40:50,174 - freqtrade - ERROR - Usage of Freqtrade requires a subcommand to be specified.

To have the bot executing trades in live/dry-run modes, depending on the value of the `dry_run` setting in the config, run Freqtrade as `freqtrade trade [options...]`.

To see the full list of options available, please use `freqtrade --help` or `freqtrade <command> --help`.2.快速开始

下面教你如何开发一个简单的交易策略。

一个策略文件往往包含这些东西:

指标

购买规则

卖出规则

建议最低投资回报率

强烈推荐止损

Freqtrade使用 Pandas 作为基础数据结构,它底层的OHLCV都是以Dataframe的格式存储的。

Dataframe数据流中每一行数据代表图表上的一根K线,最新的K线始终是数据库中最后一根。

dataframe.head()

date open high low close volume

0 2021-11-09 23:25:00+00:00 67279.67 67321.84 67255.01 67300.97 44.62253

1 2021-11-09 23:30:00+00:00 67300.97 67301.34 67183.03 67187.01 61.38076

2 2021-11-09 23:35:00+00:00 67187.02 67187.02 67031.93 67123.81 113.42728

3 2021-11-09 23:40:00+00:00 67123.80 67222.40 67080.33 67160.48 78.96008

4 2021-11-09 23:45:00+00:00 67160.48 67160.48 66901.26 66943.37 111.39292Pandas 提供了计算指标的快速方法。为了从这种速度中受益,建议不要使用循环,而是使用矢量化方法。

矢量化操作在整个数据范围内执行计算,因此,与遍历每一行相比,在计算指标时要快得多。

dataframe.loc[(dataframe['rsi'] > 30), 'buy'] = 1类似于上面这样的赋值方法,会自动设置rsi大于30的数据的buy列的值为1。

买入规则

def populate_buy_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the buy signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with buy column

"""

dataframe.loc[

(

(qtpylib.crossed_above(dataframe['rsi'], 30)) & # Signal: RSI crosses above 30

(dataframe['tema'] <= dataframe['bb_middleband']) & # Guard

(dataframe['tema'] > dataframe['tema'].shift(1)) & # Guard

(dataframe['volume'] > 0) # Make sure Volume is not 0

),

'buy'] = 1

return dataframe请注意,一定要不修改并返回"open", "high", "low", "close", "volume"列,这些是基础行情数据,如果返回错误的数据将可能会导致一些奇怪数据的产生。

如上所示的方法中,符合条件的数据的buy值会被设为1代表买入,否则为0或nan值。

卖出规则

def populate_sell_trend(self, dataframe: DataFrame, metadata: dict) -> DataFrame:

"""

Based on TA indicators, populates the sell signal for the given dataframe

:param dataframe: DataFrame populated with indicators

:param metadata: Additional information, like the currently traded pair

:return: DataFrame with buy column

"""

dataframe.loc[

(

(qtpylib.crossed_above(dataframe['rsi'], 70)) & # Signal: RSI crosses above 70

(dataframe['tema'] > dataframe['bb_middleband']) & # Guard

(dataframe['tema'] < dataframe['tema'].shift(1)) & # Guard

(dataframe['volume'] > 0) # Make sure Volume is not 0

),

'sell'] = 1

return dataframe与买入类似,这里不赘述了。

最小投资回报率

在类中增加这个初始化变量,能控制投资回报率:

minimal_roi = {

"40": 0.0,

"30": 0.01,

"20": 0.02,

"0": 0.04

}上述配置意味着:

只要达到 4% 的利润就卖出

达到 2% 利润时卖出(20 分钟后生效)

达到 1% 利润时卖出(30 分钟后生效)

交易未亏损时卖出(40 分钟后生效)

此处的计算包含费用。

要完全禁用 ROI,请将其设置为一个非常高的数字:

minimal_roi = {

"0": 100

}虽然从技术上讲并没有完全禁用,但一旦交易达到 10000% 利润,它就会卖出。

止损

强烈建议设置止损,以保护资金免受不利的剧烈波动。

设置 10% 止损的示例:

stoploss = -0.10一个完整代码如下:

3.启动机器人

启动机器人前还需要设定配置,配置模板在 config/examples 下面。

比如币安的配置,你还需要输入key和secret:

"exchange": {

"name": "binance",

"key": "your_exchange_key",

"secret": "your_exchange_secret",

......

}

}启动机器人:

freqtrade trade --strategy AwesomeStrategy --strategy-path /some/directory -c path/far/far/away/config.json--strategy-path 指定策略文件位置

-c 参数指定配置文件位置

比如我把策略放在了user_data/strategies下,配置放在了config_examples下,这么输入命令启动机器人即可:

freqtrade trade --strategy SampleStrategy --strategy-path user_data/strategies -c config_examples/config_binance.example.json由于篇幅问题,本文只是介绍了freqtrade的冰山一角,在启动机器人前,一定要进行回测并进行模拟交易。它还有TG通知功能、WebUI管理界面,详细的使用方法大家可以参考官方教程:

https://www.freqtrade.io/en/stable/

我们的文章到此就结束啦,如果你喜欢今天的Python 实战教程,请持续关注Python实用宝典。

有任何问题,可以在公众号后台回复:加群,回答相应红字验证信息,进入互助群询问。

原创不易,希望你能在下面点个赞和在看支持我继续创作,谢谢!

点击下方阅读原文可获得更好的阅读体验

Python实用宝典 (pythondict.com)

不只是一个宝典

欢迎关注公众号:Python实用宝典